Domestic silver price

As of 11:00 on April 7, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.193 - 1.230 million/tael (buy - sell); an increase of VND10,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.193 - 1.230 million VND/tael (buy - sell); increased by 10,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kilo) at Phu Quy Jewelry Group was listed at 31,813 - 32,799 million VND/kg (buy - sell).

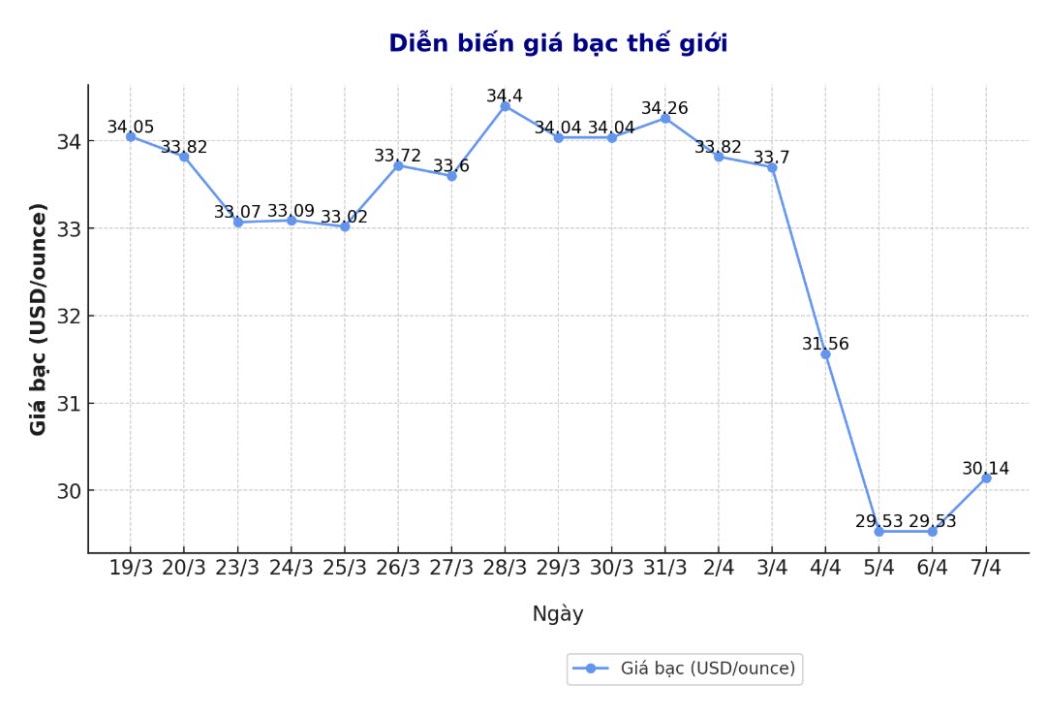

World silver price

On the world market, as of 11:10 on April 7 (Vietnam time), the world silver price listed on Goldprice.org was at 30.14 USD/ounce; up 1.8% compared to yesterday's trading session.

Causes and predictions

Gold prices suddenly reversed and increased compared to yesterday's trading session. However, Neils Christensen - an analyst at Kitco News - said that concerns about the economy are increasing as the world continues to react to the global import tax policy of US President Donald Trump, which is disrupting international trade. These concerns have caused silver prices to fall to a five-year low against gold.

Both gold and silver were affected by a wave of sell-offs in the financial market. The S&P 500 is witnessing its biggest week of decline since 2020, when the global economy closed due to the COVID-19 pandemic.

Despite the decrease in prices, gold is still more stable than the stock market. Spot gold is currently trading at $3,019 an ounce, down 4% from a peak of $3,167 an ounce on Thursday night.

Meanwhile, silver prices suffered more damage, heading towards ending the week below $30/ounce. Spot silver prices are currently at 29.62 USD/ounce, down more than 13% compared to last week.

The sharp decline in silver compared to gold has caused the gold/ silwer price ratio to surpass the 100. mark, the highest level since mid-May 2020.

Economists believe that US President Donald Trump's tax policies will have a strong impact on economic growth and could push the economy into recession. Concerns about the recession are causing industrial items to be sold off. Although silver has a partly functional role as a currency, it is still strongly affected by the large part of demand from industry.

"About half of the global demand for silver comes from industrial production. Silver plays an important role in the electrification of the global economy. However, if the economy stagnates, demand for silver may decrease accordingly," Neils Christensen commented.

Ole Hansen, head of commodity strategy at Saxo Bank, said that in addition to economic concerns, gold and silver are also affected by the release of price differences after US President's tariff threats. The majority of gold and silver have been moved into warehouses in New York to hedge against risks. However, both metals are not subject to tax, and the price difference between futures contracts and physical gold in North America has fallen sharply.

A proportion of silver poured into warehouses monitored by COMEX has increased by 51% since the beginning of the year, now at risk of being withdrawn. This could increase supply amid weak market concerns, Hansen said.

Although silver prices are currently more attractive than gold, Hansen advises investors to be cautious and should only buy when the market is stable.

See more news related to silver prices HERE...