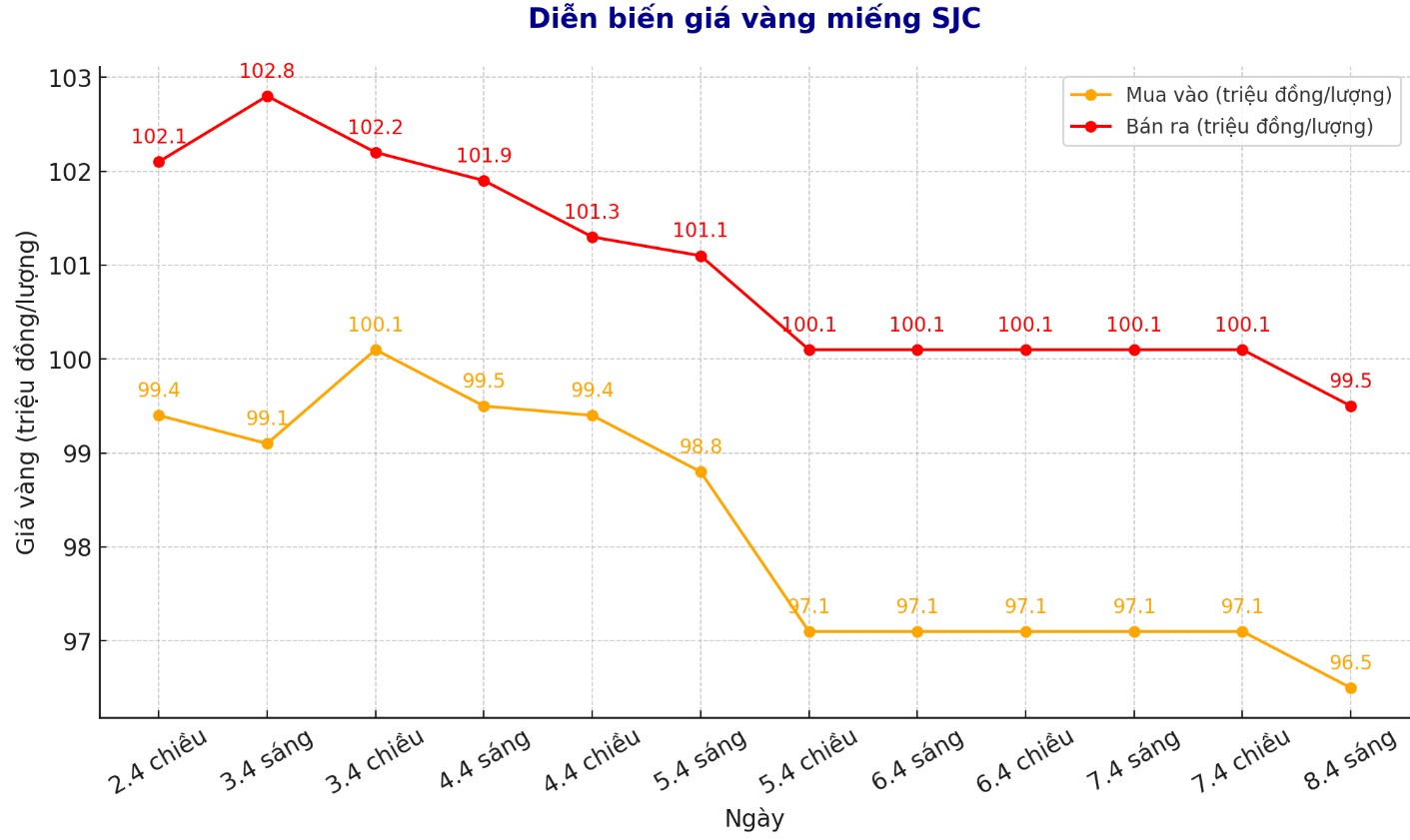

Updated SJC gold price

As of 9:10 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at VND96.5-99.5 million/tael (buy in - sell out), down VND600,000/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 96.5-99.5 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 96.9-99.5 million VND/tael (buy - sell), down 600,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.6 million VND/tael.

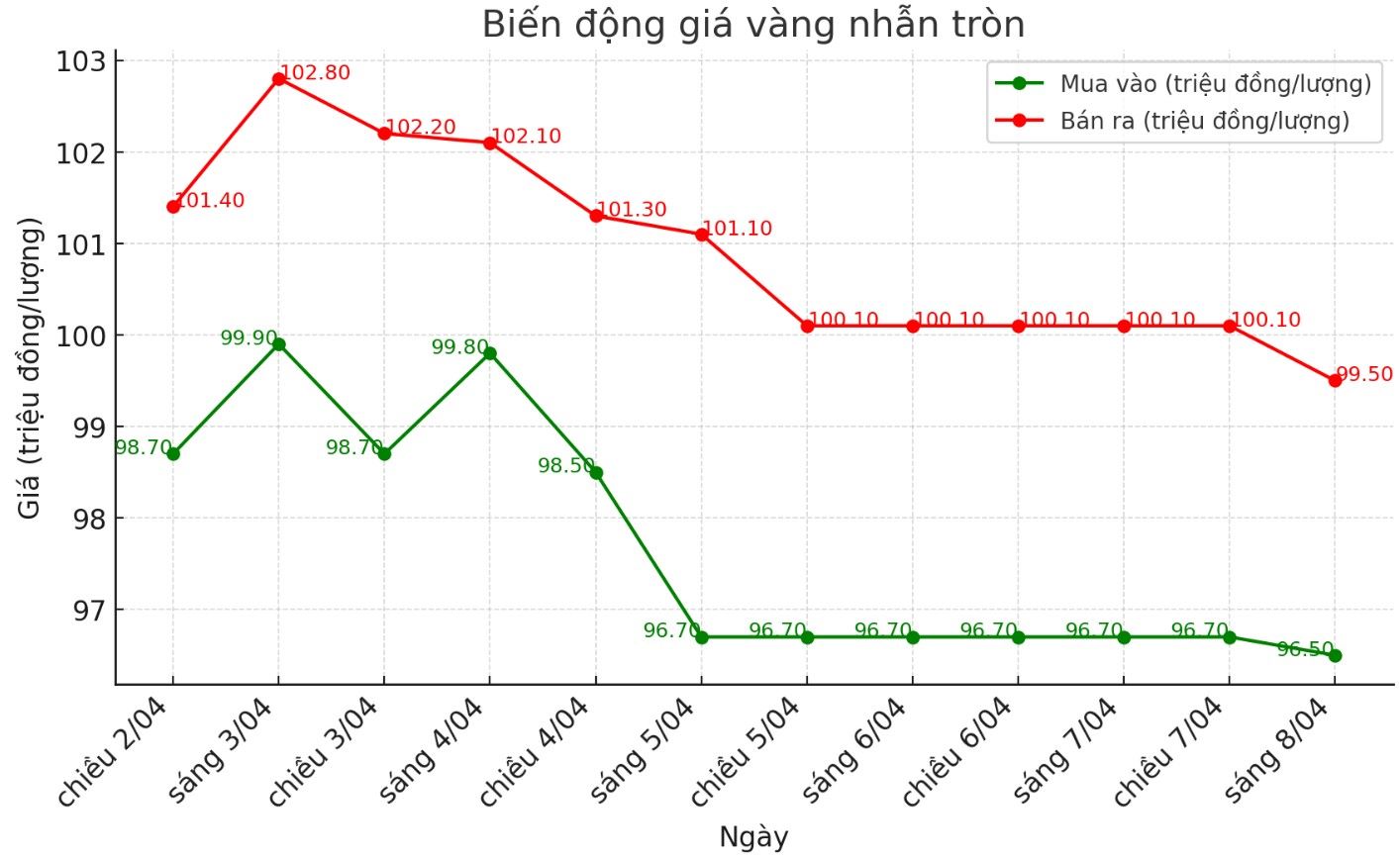

9999 round gold ring price

As of 9:30 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND96.5-99.5 million/tael (buy - sell), down VND200,000/tael for buying and down VND600,000/tael for selling. The difference between buying and selling is listed at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 96.9-99.8 million VND/tael (buy - sell), down 1 million VND/tael for both buying and selling. The difference between buying and selling is 2.9 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

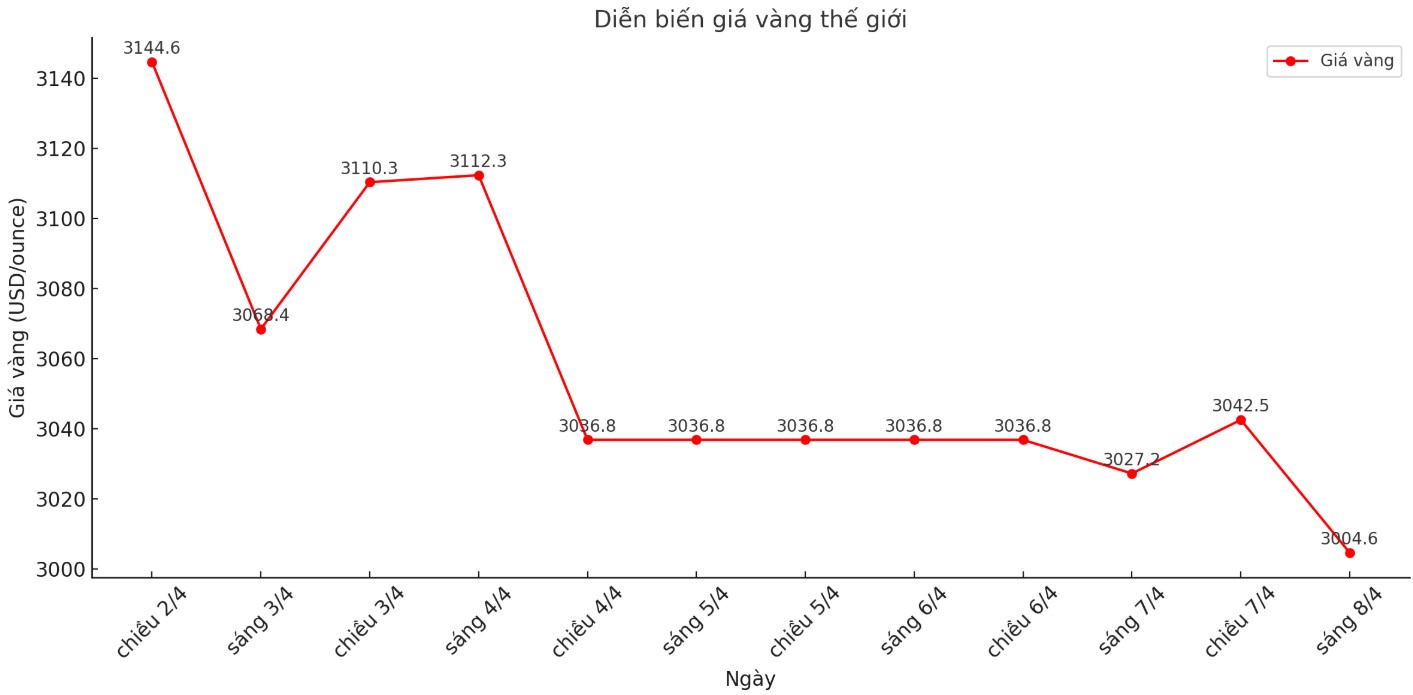

World gold price

At 9:40 a.m. on April 8, the world gold price listed on Kitco was around 3,004.6 USD/ounce USD/ounce, down 22.6 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold price forecast

Last week, the global economy struggled to cope with major fluctuations caused by US President Donald Trump imposing widespread import tariffs. Experts say gold is being sold off following a wave of leverage reduction across the market, due to concerns that a global trade war could push the economy into recession. However, gold is still in stable value, as central banks continue to net buy.

China continues to be an important factor in the market, although the gold buying rate has slowed down in recent months. Over the weekend, the People's Bank of China announced that it had purchased 3 tons of gold in March, marking the fifth consecutive month of increasing gold reserves after suspending purchases for 6 months last year.

Krishan Gopaul - market analyst for Europe, Middle East and Asia at the World Gold Council - said that since the beginning of the year, China has bought a total of 13 tons of gold, bringing its total reserves to 2,292 tons.

Although China has received much attention, the leading country in terms of central bank gold purchases is Poland. Gopaul said Poland added 16 tonnes of gold last month, bringing its total year-to-date purchases to 49 tonnes equivalent to 54% of total 2024 purchases (90 tonnes).

In an interview with Kitco News, Chris Vecchio - Director of futures and foreign exchange strategy at Tastylive.com commented that the recent tariffs have made many countries question the stability of trade relations with the US.

David Miller - portfolio manager of GOLY and investment director at Catalyst Fund said that he predicts that gold prices will continue to remain high, as it is both an alternative asset to the USD and an effective portfolio allocation tool.

Goldman Sachs (one of the world's leading financial and banking groups, headquartered in New York, USA) believes that the recent sell-off of gold was mainly due to short-term technical factors, such as investors cutting losses due to the stock market decline, as well as shifting to other assets. However, in the medium term, they still see gold as solidly supported.

We see this correction, as well as future price cuts, as an opportunity to buy gold, said Goldman Sachs experts.

See more news related to gold prices HERE...